Edward Oakley "Ed" Thorp (born August 14, 1932)

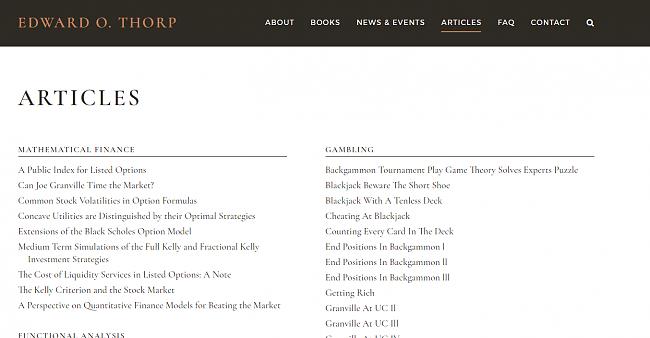

Edward Oakley "Ed" Thorp (born August 14, 1932) is an American mathematics professor, author, hedge fund manager, and blackjack player best known as the "father of the wearable computer" after inventing the world's first wearable computer in 1961.[1] He pioneered the modern applications of probability theory, including the harnessing of very small correlations for reliable financial gain[citation needed].

He is the author of Beat the Dealer, the first book to mathematically prove, in 1962, that the house advantage in blackjack could be overcome by card counting.[2] He also developed and applied effective hedge fund techniques in the financial markets, and collaborated with Claude Shannon in creating the first wearable computer.[1]

Thorp received his Ph.D. in mathematics from the University of California, Los Angeles in 1958, and worked at the Massachusetts Institute of Technology (MIT) from 1959 to 1961. He was a professor of mathematics from 1961 to 1965 at New Mexico State University, and then joined the University of California, Irvine where he was a professor of mathematics from 1965 to 1977[citation needed] and a professor of mathematics and finance from 1977 to 1982.

Thorp has used his knowledge of probability and statistics in the stock market by discovering and exploiting a number of pricing anomalies in the securities markets, and he has made a significant fortune.[4] Thorp's first hedge fund was Princeton/Newport Partners. He is currently the President of Edward O. Thorp & Associates, based in Newport Beach, California. In May 1998, Thorp reported that his personal investments yielded an annualized 20 percent rate of return averaged over 28.5 years

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Citar

Citar

Marcadores