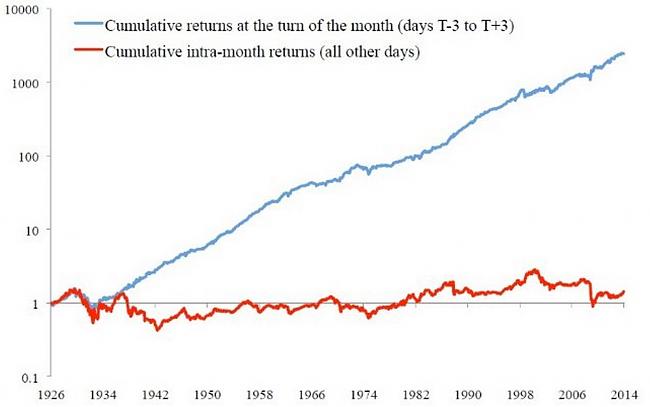

Las anomalías en los mercados financieros existen y demuestran que los mercados no son 100% eficientes.

Los inversores toman decisiones racionales pero a veces simplemente se dejan llevar por sus emociones tales como el miedo, la ambición, etc, Creando decisiones Irracionales, estas decisiones por la psicología de las masas es la que permite aprovechar el mercado para ganar dinero.

Un claro de irracionalidad son las Burbujas Bursátiles, que cuando explotan crean muchas oportunidades para comprar barato.

http://www.investorhome.com/anomaly.htm

Mr Woolley, formerly a fund manager at GMO, now believes that he can explain two of the principal anomalies which both academics and investors have found to persist over time: the “value” effect (that cheap stocks outperform in the long run), and the “momentum” effect (that winning stocks keep outperforming losing stocks).

https://www.ft.com/content/d9f70604-...a-00144feab7de

Ejemplo de Anomalía de Mercado:

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Citar

Citar

Marcadores